Aren’t you risking your credit or debit card details every time you put it on websites for online payments? How easy would it have been if a secret code provided to you could help you pay conveniently?

Let's find out…

What are Tokenization and its importance?

According to the new regulations by the Reserve Bank of India as on January 1, 2022, a customer would not have to provide the complete details of their credit or debit card all the time while making transactions online.

Tokenization is simply defined as the process where the consumers are given a unique combination of secret code for the transaction process to help them keep their data safe and protected. Customers can request their banks to provide the online merchants with the token that they can use during the online transaction procedure. This procedure would not only help the consumer to be secure while making monetary dealing but also would keep them suspended from putting the complete credit or debit card details for any future transactions.

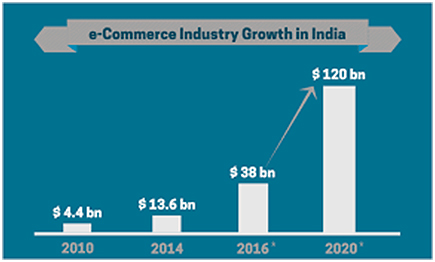

It has been observed that there is a steep curve rising in case of the e-commerce growth scenario in India which has various reasons and advantages to offer to the mass.

What is the E-commerce growth scenario in India?

According to the reports from credible sources, a very rapid growth in the e-commerce platform of businesses shifting themselves to online innovation. Since the last few years India has had the highest growth in business to consumer e- commerce platforms. With current worth of approximately 36 billion dollars the value is constantly rising to make it double-digit rates in the recent years. The forecast represents the nation to be the fastest growing and evolving opportunity for the e-commerce industry.

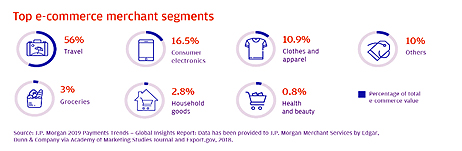

Each and every requirement and amenities of daily necessities has seen a huge shift from direct brick and mortar method to the present-day digitalization. Online transactions have taken a major part in segments like Travel, Groceries, Household Goods, Clothes and Apparel, Health and Beauty, etc.

What makes Online Transactions important?

There are a number of advantages associated with the process of online transactions. They are as follows:

- Time Saving;

- Can be executed from remote places;

- Takes cash out of equation;

- Guaranteed Efficiency and Ease;

- Removal of Potential Obstacles of Purchase;

- Increases Confidentiality and Security;

- More Hygienic and Offers a Better Experience; etc.

What are the Risks of Online Transactions?

The most important risk that is correlated with the digitalized transactions is the Lack of Privacy in various websites. Security issues can be the most neglected part when it comes to the hacking issues. The harsh reality of e-commerce sites is that they are not credible enough to prove that the financial information is not compromised over the portal. Hence, the website owners need to take important steps to stop data breaches.

How does the procedure of Tokenization work?

Step 1: Registration of Near-field Communication device with the card issuing bank.

Step 2: The bank would then send a token tied to the consumer’s number to the app registered on the device.

Step 3: Every tap-to-pay transaction alert would then be sent to the bank from where their confirmation would be required for the completion of the transaction.

This procedure would be secured from hackers as the transaction request would be directly sent and verified by the bank. The verification would be made on the basis of the device registered with them; hence any unauthorized transactions can be immediately stopped.

Taking into account all the risks and dimensions, the best possible way to get through is the procedure of tokenization. With the effect from January 1, 2022 a consumer may send requests to their banks for the token number to the e-commerce sites rather to the payment apps for future transactions.

Exclusive Blog

Read All Exclusive Blog »

With world working from home, it's time to make it enjoyable and effective.

Read DetailsHacking Tools

Explore All Hacking Tools »

UFTP is an encrypted multicast file transfer program for secure, reliable & efficient transfer of files. It also helps in data distribution over a satellite link.

Read Details